Council approves a 5.9 per cent tax increase as budget passes

Kawartha Lakes council held deliberations on the city’s 2026 capital budget at a special meeting Nov. 25, working through a proposed spending plan of approximately $126.8 million, as Mayor Doug Elmslie moved to reduce the overall tax increase next year to 5.9 per cent from the originally proposed 6.75 per cent.

Elmslie said the move reflected the financial pressures many residents are facing, adding that council felt it needed to find additional savings to bring the increase down.

“We’ve heard our residents loud and clear: this was the year to tighten up wherever we could,” Elmslie said. “At the same time, we are maintaining commitments across strategic priorities from community safety to housing to recreation.”

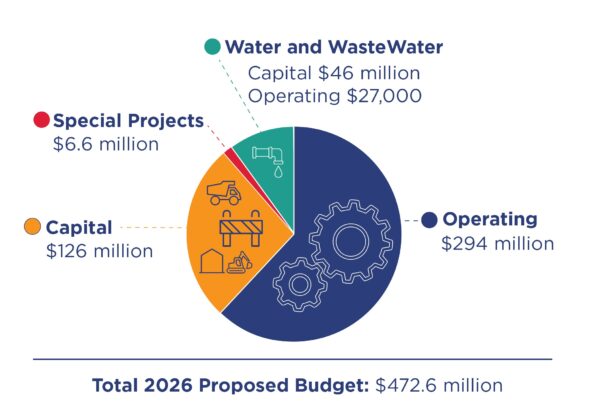

The capital budget is one of four components that make up the city’s overall $472-million 2026 financial plan, alongside the operating, special projects and water-wastewater budgets.

About $74.9 million of next year’s capital budget is directed at state-of-good-repair (SGR) costs, while $51.9 million is earmarked for expansionary capital needs.

Approximately 54 per cent of the proposed SGR investment in the 2026 budget is related to roadwork through capital programs, including bridges and culverts, urban and rural reconstruction, urban and arterial resurfacing, gravel resurfacing, and life-cycle management.

Projects outlined in the capital budget include:

– CKL Road 121 resurfacing

– Colborne Street/William Street intersection

– Colborne Street/Lindsay Street intersection

– Colborne Street Bridge construction

– Replacement of Colborne Street water mains

– Emily-Omemee Arena dressing room and lobby renovations

– Lindsay-Ops landfill weigh scales and drop-off area

– McAlpine Park rehabilitation

– Mustang Drive bridges

– Ops Park redevelopment

– Paramedic service headquarters and Fleet Centre construction

– Salem Road resurfacing

– St. Patrick Street reconstruction

– Pine Grove Cemetery columbarium

– Six replacement ambulances

The information package accompanying the budget notes that, similar to 2025’s record $127.6-million capital plan, the 2026 proposal focuses on spending that’s scaled to maintain existing infrastructure and support growth.

The information package accompanying the budget notes that, similar to 2025’s record $127.6-million capital plan, the 2026 proposal focuses on spending that’s scaled to maintain existing infrastructure and support growth.

Elmslie said preparing the 2026 budget has been demanding because the 2025 budget was stretched thin by a series of winter storms, as well as the severe ice storm in late March.

“We had an initial $13-million gap to close to be able to bring an affordable budget to the table,” the mayor said. “Today, we’ve added another $7.5 million in savings that staff will find through efficiencies in the operating budget.”

Ron Taylor, Kawartha Lakes’ chief administrative officer, underscored the emphasis the city is placing on finding the money to cover the outstanding costs, noting savings will largely need to be found in the operating budget, but all areas of the 2026 financial plan will be affected.

“It is a massive obligation and commitment that we’re putting into the budget,” Taylor told council. “It’s going to touch all areas of the operating budget – some maybe on capital, but almost entirely in the operating budget.”

Although council reserved two days for deliberations, the four budgets passed on Day 1.

Council has 30 days from the budget’s Oct. 31 posting date to amend the proposed budget. The mayor can veto amendments within 10 days, and, should this happen, council has 15 days to override a veto with a two-thirds majority.

Thank You to Councillor Mike Perry, Councillor Ron Ashmore, and Councillor Emmet Yeo who focussed on affordability and challenged a number of expenditures in the Mayor and Staff’s 2026 budget, including voting to amend the budget to reduce the proposed 40 new City employee positions, many which would have a loaded cost of $100,000 each, adding $3-$4 Million in budget cost, while the City is already dealing with a $7 Million shortfall.

The majority of councillors appeared to stand idly by, not supporting the affordability amendments of Perry, Ashmore and Yeo.

We’re left to wonder why those councillors did not speak. Wondering if those other councillors may be out-of-touch on issues of affordability. I wonder why they support adding more middle management, support adding more executive assistants and adding an executive trainer – Positions that do not serve the public or deliver a public facing service. Are those really a priority at this time?

As we head towards the 2026 Municipal Election, let’s not forget who sided with taxpayers, who sided with addressing affordability and who took real efforts to bring cost control to the CKL budget. Let’s also acknowledge that the three councillors focussed on affordability would not normally be aligned politically, and that their collective focus on affordability cuts across the usual political stripes. This was a special partnership for a special economic time.

But more importantly, remember which councillors demonstrated no interest in cost control and sat idly by, or even spoke in a supportive manner for larger and more expensive local governments. Councillors that support more back office administrative head count that does nothing for taxpayers.

Canada is experiencing an affordability crisis. Kawartha Lakes is experiencing an affordability crisis. Ontario lost 38,000 jobs in the second quarter of 2025, with a significant drop in full-time employment. Lindsay is losing manufacturing jobs.

The federal government is cutting 40,000 government jobs, and making major capital investments in economic development and international trade to stimulate growth and trade.

The City of Kawartha Lakes, the Mayor and a majority of Councillors are adding 40 local government positions, and creating unique new ways to present the 2026 budget increase, dividing the large tax increase into three separate percentage increase numbers designed to mislead taxpayers that the increase was less than it really is. Are they working for our best interest when they do that?

Council is raising development charges, making new housing even more expensive in Kawartha Lakes. Developers have recently told council that development charges are not paid for by developers, they are passed through to home purchasers, driving up the cost of new homes. Making a new home more out-of-reach for first time buyers who struggle with affordability of home ownership.

As we head into 2026, let’s look forward to the next Municipal Election which occurs on October 26, 2026.

Let’s think about affordability. Let’s think about the cost and effectiveness of the City of Kawartha Lakes municipality.

As the City staff and council spend $50,000 of your money to self-congratulate itself and themselves on 25 years of amalgamation, how do we feel about our city?

Let’s think about which Councillors have our backs, and which appear to be unable to demonstrate critical thought.

Let’s see which Councillors decide to run for Mayor, and given that the Mayor’s role is crucial in setting the budget, do we want a new Mayor who was one of the councillors focussed on affordability, or one of the councillors who stood idly by, not challenging expansioary government while Canada is in one of the most difficult economic periods of our history.

great read thanks i always knew ashmore is on the people’s side but he’s always outvoted

time for a new mayor and new councillors

let’s vote them out next election

thanks for the update on tbe budget

we do not need 49 more employees when government’s cutting

Well said. 6.9% is far too much of an increase in these difficult times. Where is all the money the Mayor stated repeatedly would be generated by fast tracking new builds for big Property Developers??? Only more money being charged to the taxpayers as far as I can see. I have seen NO benefits, only detriments.

Dianne, the increase is 5.9%, not 6.9%. You may still feel that is too much but thought I would at least point this out.

Thankyou Roderick. I didn’t know. I appreciate you correcting that figure. Why are they saying 6.9% if that isn’t true? What are you basing your figure on? Thanks.

My apologies. I just see a headline stating 5.9%. I am still a bit jet lagged so not the sharpest life in the drawer at the moment.

Hi Dianne, a tax increase just under 7% was discussed but lots of debate happened and the rate was changed. So the final number is 5.9%.

Definitely not comfortable with any tax increases . However no one has pointed out better management with our assist . Equipment has doubled in prices . New buildings don’t have to be grand but safe and functional to the public. Only when we have too much money is when the city is running properly .